The House moved closer to a final vote on Build Back Better on Thursday, hours after the nonpartisan Congressional Budget Office (CBO) released its final cost estimate of President Biden’s signature social spending plan.

The CBO said Thursday that passage of the legislation would increase the deficit by more than $367 billion over 10 years. But the estimate does not include the revenue that could be generated from increasing IRS enforcement, which the CBO suggested would be $207 billion.

Treasury Secretary Janet Yellen welcomed the CBO’s analysis: noting that the Treasury Department estimates that the crackdown on tax evaders would raise $400 billion, she said in a statement that the combined CBO scores, Joint Committee on Taxation estimates and her own department’s analysis “make it clear that Build Back Better is fully paid for, and in fact will reduce our nation’s debt over time by generating more than $2 trillion through reforms that ask the wealthiest Americans and large corporations to pay their fair share.”

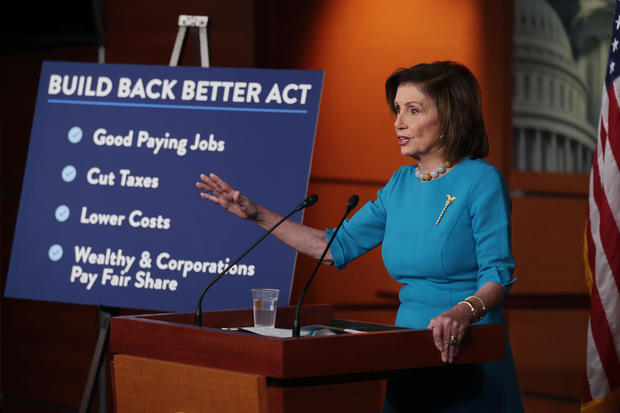

The White House called the CBO score “good news for Democrats,” and House Speaker Nancy Pelosi immediately began moving forward with the bill. Representative Stephanie Murphy, one of the key moderate holdouts who had been waiting for the CBO score to vote, said Thursday evening that she’d vote for the bill.

Chip Somodevilla / Getty Images

The CBO has been releasing estimates on individual components of the Build Back Better Act over the past few weeks, but did not address how much money the legislation would raise, or its cost, until Thursday.

TOverall, the CBO estimates the legislation would spend$1.63 trillion. The office said changes to the tax code and other provisions would generate more than $1.26 trillion in revenue and suggested increased IRS enforcement would add another $207 billion in revenue (not included in CBO totals.

Some of the CBO figures have come in lower than what the Biden administration estimated. The cost of universal pre-K and affordable child care would cost roughly $382 billion, the agency found, compared to the bill’s line item figure of $400 billion. Prescription drug reforms would save nearly $300 billion — $50 billion more than the White House estimated. Other estimates were closer: both put affordable housing related costs at roughly $150 billion. And the CBO said expanding Medicare to include hearing would cost $36 billion, while the White House said it would be $35 billion.

The CBO also estimated that a four-week paid leave included in the House version of the bill would cost $205 billion. That provision was not included in the revised White House framework because paid leave had been dropped from the bill but was later partially restored by lawmakers.

The White House, which estimated its framework would cost $1.75 trillion, has argued the legislation would be fully paid for and even claimed it would reduce the deficit over time, generating more than $2.1 trillion over 10 years.

Lawmakers and the White House were eager to see the CBO’s score, particularly after five House Democrats sent a letter to Pelosi saying they could not support the bill until they had reviewed the information and Joint Committee on Taxation to ensure the final bill was “indeed fiscally responsible.”

Senator Joe Manchin, one of the centrist holdouts in the Senate, also said he wanted to see the analysis of legislation before committing to supporting it.

Meanwhile, the Joint Committee on Taxation estimated the bill would rake in $1.48 trillion. But its analysis did not include how much revenue increased IRS enforcement would generate.

This has been a sticking point. Democrats have proposed giving the IRS $80 billion in an effort to ramp up tax collection from the wealthiest Americans. The Treasury Department estimates it would raise $400 billion over a decade, making it the largest revenue-raiser in the proposal. Some organizations and lawmakers have suggested that estimate is too conservative.

The CBO estimated the spending would generate $207 billion in new revenue, a net increase of $127 billion, far less than the Biden administration claims. Earlier this week, CBO director Phill Swagel explained ultimately the IRS would determine what additional resources would be utilized. But he said research on how effectively increased enforcement acts deters tax evasion is mixed, so his office arrived at a number closer to the midpoint of the White House estimate.

Another controversial component of the bill contributing to the price tag is the increase of the state and local tax deduction cap, commonly known as SALT. Some moderate House Democrats insisted an amendment be added that will increase the current SALT cap from $10,000 to $80,000.

The Biden administration also did not include SALT in its framework. The provision is estimated to be one of the most expensive pieces of the legislation and analysis shows it vastly benefiting the wealthiest Americans.

While those backing increased deduction argue, the cap set as part of former President Trump’s 2017 tax law unfairly hurts their constituents, it has become a point of contention among Democrats and faces obstacles in the Senate.

Jack Turman contributed to this report.