Justin Sullivan/Getty Images News

[Please note that the below article is based on two articles that were published on Wheel of Fortune on Jan. 2nd; one was posted pre-market, and the other during market hours.]

How It Started

[Based on this original post]

Pre-Market Summary (Bullet Points):

- This is not yet a trading alert (“TA”), but let’s call it a pre-market, potential, TA.

- We don’t have (and never had) a position in PayPal (PYPL), but lousy earnings certainly make this stock interesting, albeit not yet cheap (enough).

- If and when we would ask for, and employ, a margin of safety in here, to the extent that it may be as wide as a March 2020-like opportunity.

Note that the below Q4/FY 2021 earnings results of PayPal are predominantly based on this Seeking Alpha breaking news.

PayPal Holdings Q4 Earnings Report (“ER”):

- Non-GAAP EPS of $1.11, trails the average analyst estimate of $1.12 by a penny, matched $1.11 in Q3 and increased from $1.08 in Q4 2020.

- Revenue of $6.92B topped the $6.89B consensus; increased from $6.18B in Q3; rose 13% from $6.12B in Q4 2020.

- Transaction revenue of $6.38B vs. $5.61B in Q3; number of payment transactions 5.34B vs. 4.9B in Q3, and Q4 total payment volume of $339.5B vs. $310B in Q3 and rose 23% Y/Y on a spot basis.

- Venmo processed $60.6B in TPV in the quarter, up 29% Y/Y and compares with ~$60B in Q3.

- Cash flow from operations of $1.8B rose 31% Y/Y and free cash flow of $1.6B, up 38%.

- Total Payment Volume (TPV) of $339.5 billion, growing 23% on a spot and FX-neutral basis (“FXN”); net revenues of $6.9 billion, growing 13% on a spot and FXN basis.

- Net new active accounts added during the quarter, including 3.2 million from the acquisition of Paidy, were 9.8M vs. 13.3M in Q3; ends 2021 with 426M active accounts.

Q1 2022 Guidance:

The company expects Q1 adjusted EPS of ~$0.87 vs. $1.16 consensus; it also expects Q1 revenue to increase ~6% on a spot basis, with revenue, excluding eBay (EBAY), to rise ~14%.

FY 2022 Guidance:

For 2022, the payment tech firm expects adjusted EPS of $4.60-$4.75 vs. $5.26 consensus; guides for revenue growth ~15-17% at current spot rates, with revenue, excluding eBay, expected to grow ~19%-21%.

PayPal also expects to add 15M-20M net new active accounts this year, and total payment volume growth of 19%-22% at current spot rates, that’s less than the 23% TPV growth it had in 2021.

“We are evolving our customer acquisition and engagement strategy, and we now expect to add 15M to 20M net new customer accounts this year,” said John Rainey, PayPal’s CFO and VP, Global Customer Operations, during the company’s earnings call. “In addition, we no longer believe that the 750M medium-term account aspiration we set last year is appropriate.”

- Expect TPV to reach $1.5 trillion and revenue to surpass $29 billion.

- TPV expected to grow 19%-22% at current spot rates and 21%-23% on an FXN basis.

- Revenue expected to grow 15%-17% on a spot and FXN basis; excluding eBay, revenue expected to grow 19%-21%.

- GAAP EPS expected to be in the range of $2.97-$3.15; non-GAAP EPS expected to be in the range of $4.60-$4.75 vs. $5.26 consensus.

- 15 to 20 million NNAs are expected to be added to PayPal’s platform in FY 2022.

How It’s Going

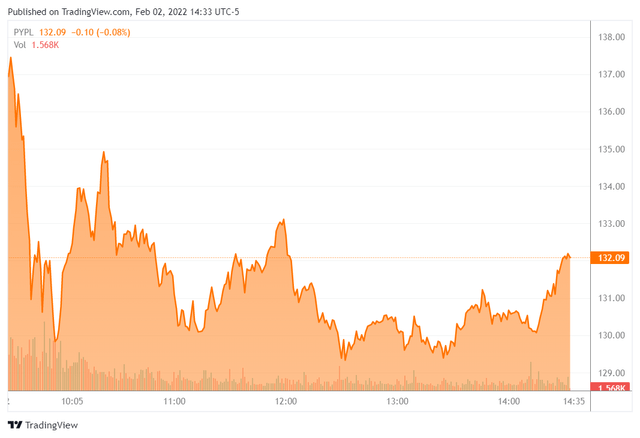

As a result, the stock is down over 16% in pre-market trading:

Source: Twitter

Just to make it clear:

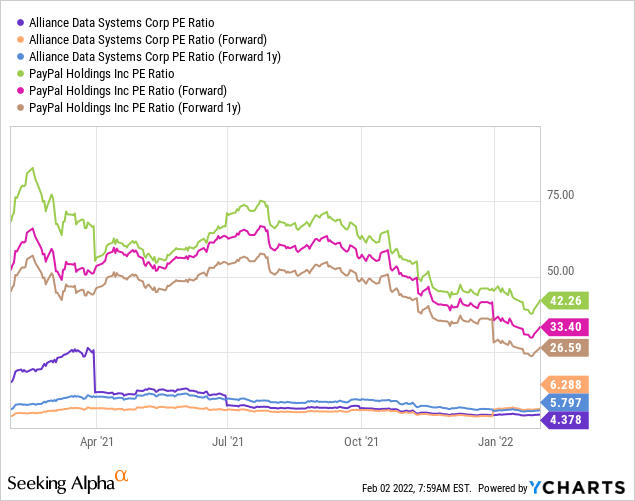

1) We prefer “our” Alliance Data Systems Corp (ADS) over PYPL any day, any time. The difference in valuations is simply unreal.

2) Even with today’s massive drop, PYPL would be anything but cheap.

YCharts

3) Having said that, we like opportunities and PYPL at low $140s is starting to look like an opportunity, from a volatility and option-trading perspective.

Here is the volatility before accounting for today’s action, which surely is likely to jump today to the highest level since March 2020:

YCharts

What We Aim At

Look at these charts; they are what we call “perfect”, because they tell you exactly what level you need to focus on, regardless of (good/bad) earnings.

We believe that there’s no need to say anything about this chart:

YCharts

And as a matter of fact, we also believe that there’s no need to say anything about this chart either:

[See how synchronized the two, green and red, lines are, pointing to the exact same target level]

YCharts

To make a long story short, we would be looking to see long-dated expiry/ies (in light of the high volatility) using ATM (perhaps slightly ITM) or (up to) 10%-20% OTM strikes that would give us the stock (net price, upon assignment) at no more than $120, hopefully even closer to $100.

All in all, $100 would be a fantastic price to get PYPL for, not only because it would be a circa 70% cut off the all-time high, but simply because at that level even the company’s revised guidance for an EPS of $4.60-$4.75 in 2022 would start making sense (let’s call it an around 20x multiple).

Recall that $82.07 was the low of the March 2020 lows. If selling PUT options gets us there, that would really be a sad day for PYPL, but a real happy day for us…

Taking into account how bullishly wrong Wall Street has been on the stock, it’s even more alarming (and somewhat pleasing…) to see how analysts react to the disappointing earnings.

That’s before the ER:

YCharts

Wall Street: Too Little, Too Late

Here’s what analysts have to say following the ER (Note that this section is predominantly based on this Seeking Alpha breaking news):

BTIG analyst Mark Palmer cuts the stock to Neutral from Buy and removes his $270 price target after the company’s soft 2022 guidance and shift in customer acquisition strategy raises questions about its near-term prospects. “As such, we now view PYPL as a ‘show me’ story as the company would need to demonstrate that it is still capable of sustaining revenue growth north of 20% on a normalized basis before we would be comfortable assigning it the kind of premium multiple that would indicate significant upside from current trading levels,” Palmer wrote in a note to clients.

He’s still constructive on the long-term perspective for its payments platform and “super app” that it’s been building. But shorter term issues limiting growth include management’s shift of increasing user engagement rather than spend on marketing to attract new customers and external factors including inflation hurting consumer spending and supply chain disruptions hurting its small-business merchants.

Raymond James analyst John Davis cuts his rating on the stock to Market Perform from Outperform.

Oddo BHF analyst Martin Marandon-Carlhian reduces his rating to Neutral from Outperform, sets price target at $200.

Evercore ISI analyst David Togut slashes the price target to $245 from $342. “Supply chain management problems, inflationary pressure on spending by low-income customers, and ongoing, steep declines in eBay volumes created stiff headwinds exiting 4Q/21 that will persist at least through 1H/22, driving 1Q/22 and 2022 guidance well below consensus,” he wrote.

Togut maintains his Outperform rating on the stock and it remains his Top Payments Pick for 2022. He sees the stock’s ~24x Evercore’s revised 2023 EPS estimate as “an attractive valuation given a longer-term EPS growth rate of +20%.”

Truist analyst Andrew Jeffrey cuts his price target on PayPal to $130 from $200 and reiterates his Hold rating. “We think the market is still too bullish on long-term organic revenue growth, despite recent underperformance,” he said in a note, and advises that investors look to traditional payment networks. He notes that PayPal management’s macro comments contrast with the bullish outlook expressed by Visa (V) and Mastercard (MA).

How It Ended

[Based on “TRADING ALERT/S: February 2, 2022 / TAD”]

TAD only:

SELL (to open) PYPL 06/17/2022 115.00 PUT @ $8.60

SELL (to open) PYPL 06/17/2022 120.00 PUT @ $10.90

SELL (to open) PYPL 06/17/2022 125.00 PUT @ $13.20

SELL (to open) PYPL 06/17/2022 130.00 PUT @ $15.50

SELL (to open) PYPL 06/17/2022 135.00 PUT @ $17.80

SELL (to open) PYPL 07/15/2022 140.00 PUT @ $20.80

SELL (to open) PYPL 01/20/2023 110.00 PUT @ $12.40

SELL (to open) PYPL 01/20/2023 115.00 PUT @ $14.70

SELL (to open) PYPL 01/20/2023 120.00 PUT @ $17.00

SELL (to open) PYPL 01/20/2023 125.00 PUT @ $19.30

SELL (to open) PYPL 01/20/2023 130.00 PUT @ $21.60

SELL (to open) PYPL 01/20/2023 135.00 PUT @ $23.90

SELL (to open) PYPL 01/20/2023 140.00 PUT @ $26.20

For each of the above 13 TAs (together or separately):

Risk Rating: 3 >>> Maximum* Allocation: 5%

*Doesn’t equate suggested!; obviously, that’s an aggregate max. alloc. after taking into consideration all past and/or today’s straight BUYs and/or sold PUTs, if there’s any.

If there’s one thing you can’t say today, it’s that you haven’t been warned…

Following the investment thesis that we’ve laid out earlier today, and in-line with what we wrote on chat (see below), we’re selling PUTs on PayPal this morning as if they are hot cakes.

To wit, a couple of chat posts that are relevant to this action:

9:00 AM ET: “Assuming that we get a net price of <=$120, surely if <=$100, I'd say this is 3, and perhaps even 2.5-3 if we get to as low as $80 (unlikely)"

9:01 AM ET: “I’ll be unavailable over the next hour, and so if you can nail PYPL PUTs based on the pre-market guidance – shoot, don’t talk/wait. I’ll issue the TAs only once I’m back online. “

12:16 PM ET: “I’ve been asked which options to focus on for someone who doesn’t want to do all of those? Answer: If you’re into maximizing return: Start with the higher strikes (130-140) with the dates being a minor consideration (leaning towards the June expiry for max % return or for Jan expiry for max cash/monetary income). If you’re into maximizing safety: Start with the lower strikes (110-120) and the June expiry. Hope this helps”

Why do we repeat all these posts here?

- They’re all relevant for these TAs.

- To show/prove how well-prepared you’ve been in advance.

- To remind you that while the chatroom isn’t a must (you get everything outside, just as you get inside), it’s worthwhile keeping an eye on it.

Here are all the options we’re selling, including their net prices (if and when they get assigned), and the net price (if all options get assigned), assuming equal-weight across all these TAs:

| PYPL PUT Sold | Premium | Net Price | Strike-Premium |

| PYPL 06/17/2022 115.00 | $8.60 | $106.40 | =115-8.60 |

| PYPL 06/17/2022 120.00 | $10.90 | $109.10 | =120-10.90 |

| PYPL 06/17/2022 125.00 | $13.20 | $111.80 | =125-13.20 |

| PYPL 06/17/2022 130.00 | $15.50 | $114.50 | =130-15.50 |

| PYPL 06/17/2022 135.00 | $17.80 | $117.20 | =135-17.80 |

| PYPL 07/15/2022 140.00 | $20.80 | $119.20 | =140-20.80 |

| PYPL 01/20/2023 110.00 | $12.40 | $97.60 | =110-12.40 |

| PYPL 01/20/2023 115.00 | $14.70 | $100.30 | =115-14.70 |

| PYPL 01/20/2023 120.00 | $17.00 | $103.00 | =120-17.00 |

| PYPL 01/20/2023 125.00 | $19.30 | $105.70 | =125-19.30 |

| PYPL 01/20/2023 130.00 | $21.60 | $108.40 | =130-21.60 |

| PYPL 01/20/2023 135.00 | $23.90 | $111.10 | =135-23.90 |

| PYPL 01/20/2023 140.00 | $26.20 | $113.80 | =140-26.20 |

| Assuming all 13 options have | equal-weight | $109.08 |

Note that the stock has actually traded even lower after we announced these TAs, meaning that you’re very likely to be able to execute all/most of the above-mentioned, perhaps even for higher premiums than the ones we got.

Seeking Alpha

Meanwhile, just as expected, volatility is jumping to >60% on the short expiry dates (up to 6 months) and over 50% on the longer-dated expiries (9-12 months). This is why we’re selling two sets of options; the first one (June-July 2020) is to capture maximum volatility, and the second one is to capture maximum tenor (which is suitable for high/spiking volatility).