The free-money virus turned investors’ brains to mush. But the healing has started, interest rates are recovering, QT is here, and look what we got.

By Wolf Richter for WOLF STREET.

Let’s just walk through some of the already Imploded Stocks that further imploded on Friday. There were quite a few of them, as is now usually the case during earnings season, but we’ll just look at a handful. They imploded even as markets rallied for the day. On Friday, the Nasdaq rose 1.3%, reducing its loss for the week to just 5.6%, that kind of week. But a whole bunch of stuff plunged after reporting “earnings” – I’m using that term loosely because they all reported huge losses on top of endless losses.

Carvana, an online used-vehicle retailer, is one of the earliest entries into my pantheon of Imploded Stocks. Thursday evening, it reported “earnings” – you know what I mean. Everything went the wrong way: The number of vehicles it sold to retail customers fell, revenues fell, cost of sales jumped, gross profit plunged, selling and administrative expenses soared, interest expense more than tripled, and the net loss exploded to $508 million.

The used-car startups Carvana, Vroom, and Shift “face an existential crisis,” I wrote in April 2022, based on the changing dynamics in the used vehicle market, the fading willingness of investors to keep fueling cash-burn machines, and driven by the used-vehicle startups themselves that were never designed to make money and never could figure out how to make money, not even in the hottest used-vehicle market ever in 2021.

They were designed to burn investor cash. And investors no longer want their cash to be burned. And so that existential crisis is now.

Back when I issued the existential crisis warning in April 2022, Carvana [CVNA] had plunged by 73% from the high to $100 a share. Since then, they’ve plunged further with relentless brutality. On Friday, Carvana kathoomphed 39%, to $8.76, down 98% from the peak in August 2021, and down 41% from its IPO price in April 2017. Buy and hold, folks.

The chart displays the now classic pattern of how the Fed’s trillions of dollars in QE and interest rate repression – the free-money era started in 2009 – mutated over the years into a virus that turned investors’ brains into mush, and after their brains had turned into mush, they inflated asset prices to ridiculous levels.

But the healing from the free-money virus has started. Interest rates are reverting to some kind of normal, QT is now working, and look what we got. Nearly all charts of my Imploded Stocks look similar (data via YCharts):

In a market where investors’ brains function properly, Carvana’s inability to make money selling used vehicles should have doomed the stock to the penny-stock realm years ago.

Armies of falling-knife catchers that thought they could make money after the shares had plunged by 73% in April 2022 have gotten their beloved fingers sliced off with another 91% plunge. Shares have collapsed so far that you can barely see the 38% plunge on Friday, that little dip at the end of the collapse.

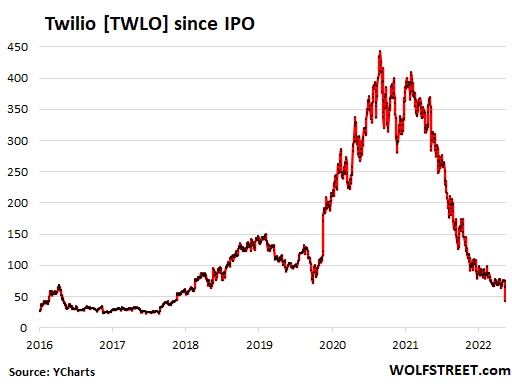

Twilio [TWLO], a cloud communications platform, reported “earnings” Friday morning. Part of the problem was that revenues grew by 32% to $983 million while the net loss exploded by 115% $482 million. The company also issued disappointing revenue guidance.

How can a company that has been publicly traded for seven years, and has been around for 14 years, and had $3.5 billion in revenues over the past 12 months still generate a $482 million loss on $983 million in revenues? That was a rhetorical question.

Every year, the company has generated larger and larger net losses, reaching nearly $1 billion in 2021, and heading for well over $1 billion this year, following the free-money-virus-infected Silicon Valley model: the more they sell, the more they lose.

People that run companies in this way have no idea what it’s like to run a profitable company. It’s not even on their horizon, and it wasn’t on the horizon of their investors. But it’s starting to be.

Shares collapsed by 34.6% on Friday, and are down 91% from their high in that infamous February 2021, when this stuff started to come unglued. Note the now classic Imploded Stocks bubble and collapse pattern. It’s just a simple fact: Free money turns investors’ brains to mush (data via YCharts).

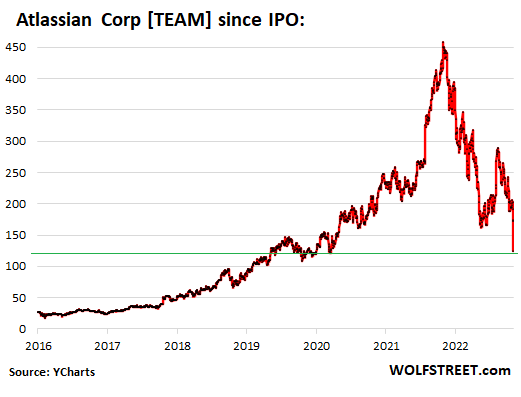

Atlassian Corp [TEAM], a collaboration and productivity software company in Australia that is traded on the Nasdaq, is another one of those shining free-money examples that never figured out how to make money, never even tried, and is just losing huge amounts of money year-after-year: over the past four years alone, it lost $2.3 billion combined, even as its revenues surged.

In other words, it is just buying its revenues. And for a while, that’s all that mattered to investors whose brains had been turned to mush by the free-money virus.

But when it reported earnings on Friday, the company talked about feeling the impact of the global economy – the hiring slowdown at its existing customers resulting in slower demand for collaboration software – and it said the rate at which users of its free versions converted to paid versions was cooling. It said that it would slow down its own headcount growth going forward, and it gave a disappointing outlook.

Shares kathoomphed 29% on Friday to $124.01 and are down 74% from peak mania in October last year. This chart looks awfully close to Carvana’s chart did back in April when it had plunged to $100. Each implosion had a different start date, and each plunge brought out the dip buyers that then got their fingers sliced off, and it will happen again because there are still dip buyers out there with some fingers left on their hands that they want to get sliced off (data via YCharts):

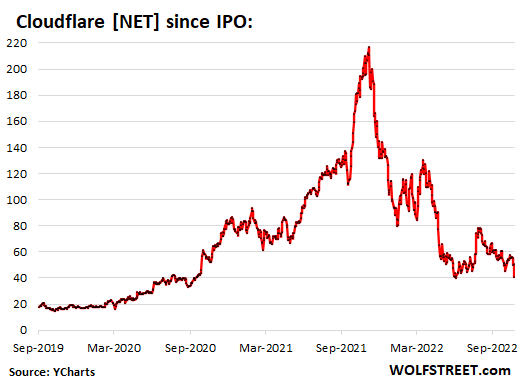

Cloudflare, a cybersecurity company, reported earnings late Thursday – yup, another huge loss. While revenues jumped 47%, the operating loss jumped 73%. The more they sell, the more they lose – following the Silicon Valley growth model during the free-money-virus era. Guidance was also light.

But the free-money-virus is fading, and brains are recovering from it, and on Friday its shares kathoomphed 18.4%, to $41.09, down 81% from the peak in November last year.

The stock is roughly eight months behind the first batch of heroes in my pantheon of Imploded Stocks that started to come unglued in February 2021 (data via YCharts):

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.