Investors worldwide issued a sceptical verdict on Xi Jinping’s third term in office, selling shares in Chinese companies after the country’s leader wrapped up a Communist party congress that signalled a shift in focus from the economy to security.

The sell-off began on Monday morning in Asia, where Hong Kong’s Hang Seng Tech index fell 9.7 per cent, a one-day move that matched its largest ever drop. It continued into the US trading day, where several of the most well-known Chinese tech groups listed on Wall Street fell sharply.

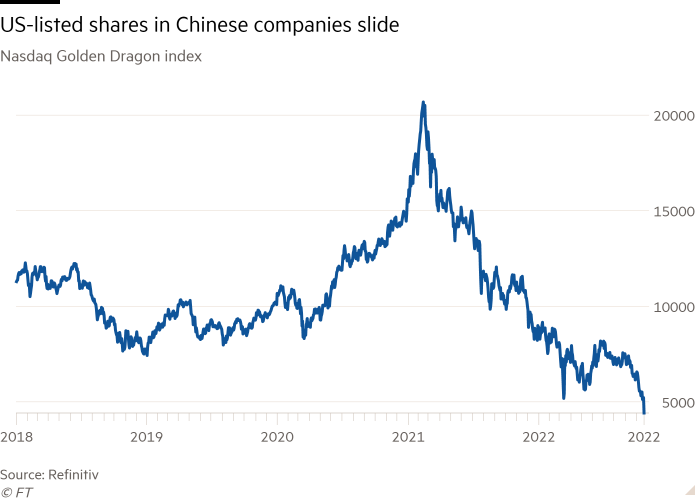

Nasdaq’s Golden Dragon index, which tracks US-listed shares in Chinese companies, fell 14.4 per cent as Alibaba, JD.com and Pinduoduo faced heavy selling. The record one-day drop for the index left it down by about 50 per cent this year.

Analysts said that the sell-off was compounded by Beijing’s release of economic data, delayed while the party conference was under way, that showed China’s economy grew by 3.9 per cent year-on-year in the third quarter, below the government’s annual goal of 5.5 per cent.

But they also noted that Xi’s overhaul of the party leadership during the week-long 20th party congress, which ended at the weekend, had given power to loyalists more concerned with China’s geopolitical rivalry with the US than with economic reform.

“The risk is more about groupthink and thought capture and the line about the dire need to struggle with the US,” said Gerard DiPippo, a former senior China economy analyst at the CIA. “It is reasonable from a market perspective that, whatever hope you had of a liberal turn in China, is probably lower now than it was on Friday.”

In the months leading up to the party congress, Xi had shown a growing disregard to economic reform, enforcing strict Covid-19 lockdowns despite its impact on the Chinese economy. He has also launched a regulatory crackdown on some of the country’s fastest-growing technology groups.

“Chairman Xi clearly wanted a team to execute on his vision,” said one US industry executive.

Frank Benzimra, head of Asia equity strategy at Société Générale, said investors had been unsettled by the shift in membership of the party’s top leadership body announced on Sunday, which was stacked with cadres more focused on national security than economic reform.

“While Chinese politics have long been opaque, this sharp consolidation of power is adding to investor unease,” said Mark Haefele, chief investment officer of UBS’s Global Wealth Management. “Equity valuations, already near a 10- year trough, will likely face more pressure if international investors demand a higher risk premium.”

Among the biggest corporate names to suffer in the sell-off was Alibaba, which closed 12.5 per cent lower in Wall Street trading, pushing its shares below the $68 offering price it went public at in New York eight years ago, in what was at the time the world’s largest listing.

The company has increased its revenues more than 14-fold and doubled adjusted profits in the years since its market debut. But shares have been sliding since 2020 after Beijing cancelled the IPO of digital payments affiliate Ant Group, which had been set to raise a record $37bn.

Alibaba’s 80 per cent decline in that period reflects a loss of about $670bn in equity market value. The tech company in August reported its first quarterly revenue decline since its listing in New York.

Monday’s shakeout highlights the mounting challenges faced by China’s largest tech groups since Xi launched a regulatory crackdown on the sector.

One Alibaba employee said the government’s tech crackdown and the sinking share price had sapped “drive and energy”.

“Over the past one to two years people have stopped working hard,” the person said, noting they personally worked about 20 fewer hours a week.

Alibaba’s filings also show the company has shed more than 13,000 positions since the start of the year.

Additional reporting by Nian Liu in Beijing, Patrick Mathurin in London and Eric Platt in New York