I see gasoline prices rising further despite this modest short-term & long-term demand destruction.

By Wolf Richter for WOLF STREET.

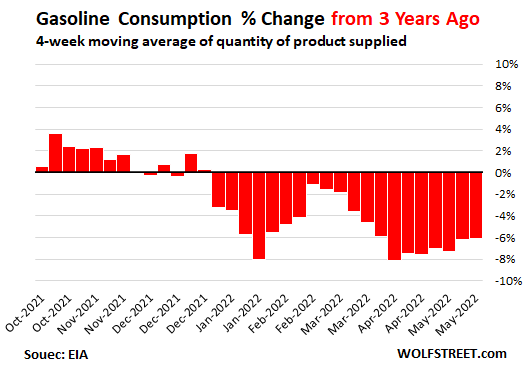

The price mayhem going on at the pump is now leading to some demand destruction. We’ve been seeing signs of it. We’re in the beginning of driving season, but gasoline demand is not following the classic pattern of a seasonal surge.

The Energy Department’s EIA reported that gasoline consumption, at 8.85 million barrels per day (four-week moving average) was down by 2.7% from the same period in 2021, and by 6.1% from the same period in 2019. Consumption in 2022 (red line) is not following the summer driving surge: it’s up only 1.3% from early March. But in May 2019 (gray), consumption was up 5.2% from March, and in May 2021 (black), consumption was up 11.9% from March.

Note that the EIA measures consumption of gasoline in terms of barrels supplied to the market by refiners, blenders, etc., and not by retail sales at gas stations.

In October, November, and December last year, gasoline consumption ran above the levels in 2019. It’s when the gasoline price shock started spreading among consumers that consumption took a hit, but it hasn’t taken a big hit yet, and consumers seem to be getting used to the pain, and demand destruction hasn’t worsened over the past few weeks:

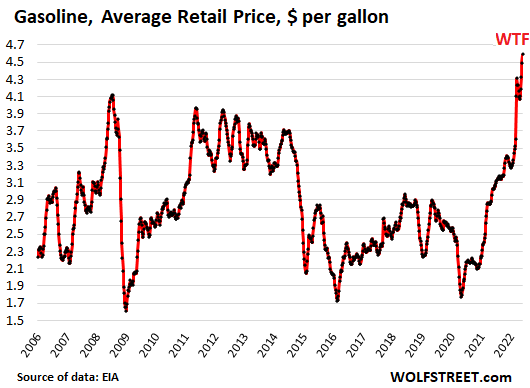

What consumers are facing at the pump is a majestic spike in gasoline prices, that included a little dip in April to confuse everyone and to spread some false hopes that the price spikes were over. In May, the price spikes resurged to new records. On Monday, the EIA’s weekly measure reached $4.59 per gallon of regular:

Long-term demand destruction happening, but it’s a slow process.

The peak years of gasoline consumption were 2016, 2017, 2018, and 2019, all at about 9.3 million barrels per day, and just a tad higher than 2007, with a trough of -6.3% in between. During the summer driving season, the peaks reached 9.7 million barrels per day.

The years 2016-2019 may turn out to have been peak US gasoline consumption. The current price spike is shifting vehicle buying patterns once again to more economical vehicles, including smaller vehicles and hybrid powertrains, and we’re already seeing signs of that. These shifts in buying patterns have long-term consequences on gasoline consumption.

Legacy automakers are finally rolling out EVs, and though large-scale production is still handicapped by the various shortages, particularly the semiconductor shortage that is hitting automakers on all their models, there is huge demand for EVs and long waiting lists. The 1.44 million EVs on the road in the US account for only 0.5% of the 280 million vehicles in operation, but EV sales are booming, and ICE vehicle sales are falling, and every percentage gain in the share of EVs represents a visible drop in gasoline consumption.

And the wave among office workers of working-from-home during the pandemic has turned into a sort-of permanent trend to working at least part of the time from home, with commutes no longer being a daily thing, but may be a thing two or three times a week, which dramatically cuts gasoline consumption for those households, especially households that have long commutes, and enough of those households doing this will take some visible demand off the table.

Short-term demand destruction.

Spiking gasoline prices, when they hit the pocket book enough, trigger some changes in what people do: They start driving less, start taking it easier to conserve gas when they do drive, and start prioritizing the most economical vehicle in their household. They might cancel road trips, and minimize driving while on vacation.

But these are short-term effects, things that people might do this year, or this month, but once they get used to the higher gas prices, and perhaps get a raise that will make those high gas prices less toxic, some of those changes will unwind.

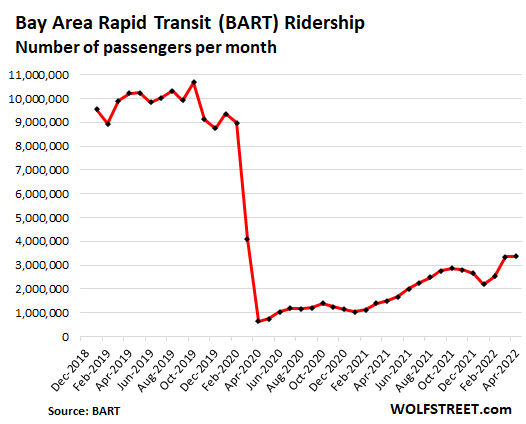

Demand destruction as people revert to mass transit yet?

How much will gasoline prices have to spike before people return to commuter trains? The commuter train systems across the US have taken a massive loss in ridership during the pandemic, as people started driving to work or stayed home to work.

So is the current price spike enough to get people back into trains? Let’s look at the San Francisco Bay Area’s BART trains. Here, drivers face gasoline prices in the $6 range, bridge tolls that have been jacked up, and traffic congestion that is nearly as bad as it was before the pandemic. That would be a big incentive to get back on the BART.

So let’s see. Yup, in March, when gasoline prices spiked to new records, BART ridership jumped by 32% to 3.34 million rides, from 2.52 million in February. And in April, when gasoline prices dipped a little, ridership increased a tad to 3.38 million. And now in May, when gasoline prices at many gas stations are over $6 a gallon – well, we have to wait till the May data comes out. I expect another jump in ridership, similar to March. So gasoline demand destruction by people reverting to mass transit is taking place, but only in baby steps, and ridership remains 67% below the 10 million range before the pandemic:

I see gasoline prices going higher despite this modest demand destruction.

There is some modest demand destruction from short-term changes in driving behavior, from long-term changes in the kinds of vehicles that people buy, and from people reverting to mass transit in baby steps. But it’s not a collapse in demand, just a modest decline that will go on for years.

And the industry can figure this out too, and they’ll continue to cut investment and capacity to deal with this slowing demand. And nothing changes. If it were a suddenly collapse in demand, it would be different. But that’s not happening at these prices.

Enjoy reading WOLF STREET and want to support it? Using ad blockers – I totally get why – but want to support the site? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.