Here’s one possible all-clear signal. COVID-19 is no longer a “tail risk” for investors, the first time since February 2020, says Bank of America in its latest fund manager survey. A tail risk is an unlikely event that could cause outsize losses or gains.

Scroll down for that chart.

Meanwhile, the Federal Reserve’s two-day policy meeting begins on Tuesday, and investors will be on the lookout for any hawkish signals that could take some steam out of stocks. The premarket is showing some mixed action after some disappointment over retail sales.

But many remain stuck into the idea of a post-pandemic boom, at least in the U.S. as vaccinations roll out.

Read: Value stocks are making a comeback. Don’t get left behind, these analysts say

That has kept the records coming for the Dow Jones Industrial Average

DJIA,

and S&P 500

SPX,

and those stocks geared toward a recovery. Our call of the day comes from strategists at Bank of America, who offer up 17 stocks to buy for the three R’s they see coming — recovery, reflation and rerating.

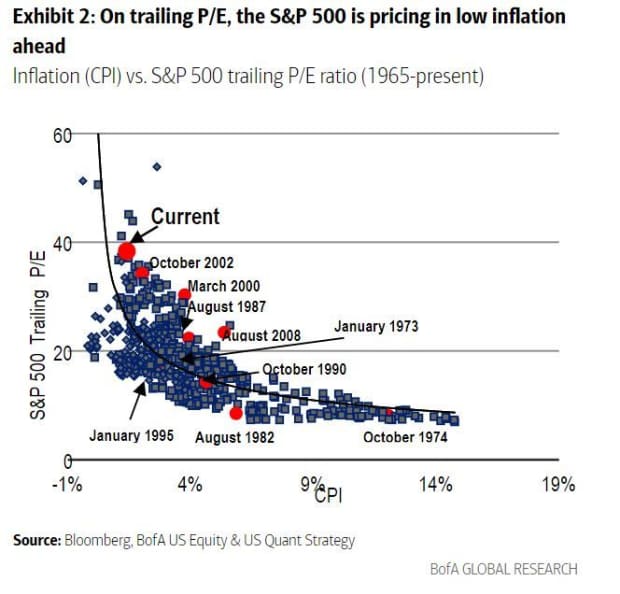

Strategists Jill Carey, Savita Subramanian and Ohsung Kwon say the economy has reached the mid-cycle phase, where inflation typically is strongest. In prior such phases, excluding the technology bubble, small-caps have outperformed larger ones, and value has beaten growth.

Uncredited

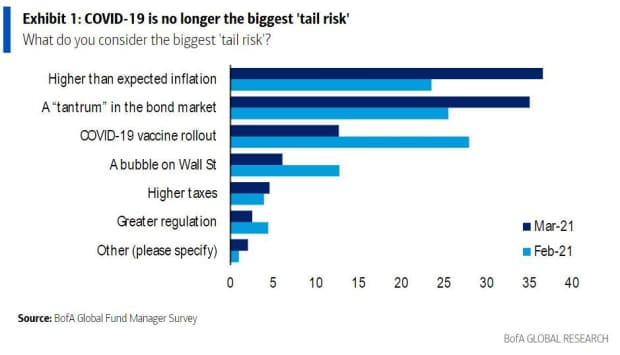

The Bank of America team says there are two reasons to like those stocks: many of the companies they highlight are still not expensive, and active funds aren’t positioning for that rising inflation, with heavier exposure to mega than smaller caps.

Uncredited

Uncredited

Onto the stocks (nearly half are small-to-midcap companies)…

Alcoa

AA,

— BofA has a share price target $37 for the miner. Aluminum prices could go either way, but global demand growth is a plus for Alcoa.

Axalta Coating Systems

AXTA,

— Share price target £37 for the global coatings group. The pace of automobile recovery will be key and a stronger dollar and lower raw material costs could be a boost.

Broadcom

AVGO,

— Share price target $550. Risks for the semiconductor company include sensitivity to U.S.-China trade relations and competition in networking, smartphone and other markets.

Hess

HES,

— Share price target $95. Among the energy company’s risks are oil and gas prices, as well as slowing developments in drilling.

Marriott International

MAR,

— Share price objective $150. Economic weakness and worse-than-expected spending by businesses and consumers are among the risks for the hospitality company.

Walt Disney

DIS,

— $223 price objective for the entertainment giant that has “best in class assets.” Downside risks include slowing ESPN growth from people deciding not to keep a cable television subscription, weaker consumer confidence, and low theme park attendance. Also watch out for potential film flops.

As for the rest, they like CNH Industrial

CNHI,

Comcast

CMCSA,

Emerson Electric

EMR,

Herc Holdings

HRI,

Knight-Swift Transportation

KNX,

Occidental Petroleum

OXY,

Parker Hannifin

PH,

Principal Financial

PFG,

Robert Half International

RHI,

Union Pacific

UNP,

and World Fuel Services

INT,

The chart

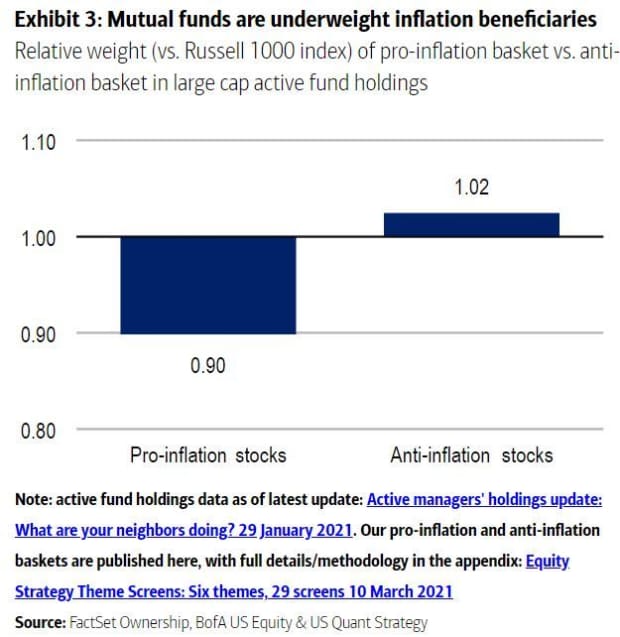

Here’s that “tail risk” chart from the latest BofA monthly fund manager survey. Bigger risks are higher-than-expected inflation and a “tantrum” in the bond market.

Uncredited

The markets

Dow and S&P futures

YM00,

ES00,

are flat, while Nasdaq-100 futures

NQ00,

are up. European stocks are higher

SXXP,

It was also an up day for Asian markets. Elsewhere, oil

CL.1,

and the dollar

DXY,

are weak and bitcoin

BTCUSD,

is backing further away from the $60,000 hit over the weekend.

The buzz

Retail sales dropped a bigger-than-expected 3% in February, though they surged a revised 7.6% in January. Import prices rose 1.3%. That data will be followed by industrial production and a National Association of Home Builders index. Aside from the Fed meeting kickoff, investors will also be watching the outcome of a an auction of 20-year Treasury bonds.

Ray Dalio, the founder of Bridgewater, the world’s biggest hedge fund firm, declares investing in bonds as “stupid” and investors should stick to a “well-diversified portfolio.”

AstraZeneca

AZN,

AZN,

shares are higher after Jefferies upgraded the drug company to buy from hold. AstraZeneca has been in the hot seat as several European countries suspend its COVID-19 shots over reports of blood clots from inoculations.

Finnish telecoms group Nokia

NOKIA,

NOK,

is cutting up to 10,000 jobs to save $716 million over two years.

A team from the U.S. government’s highway safety agency is headed to Detroit to investigate a “violent” crash after a Tesla

TSLA,

vehicle drove under a semitrailer, leaving two people critically injured.

Random reads

Office nostalgia — Redditers swap coworkers-from-hell stories.

When a hacker gets all your texts for $16.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.